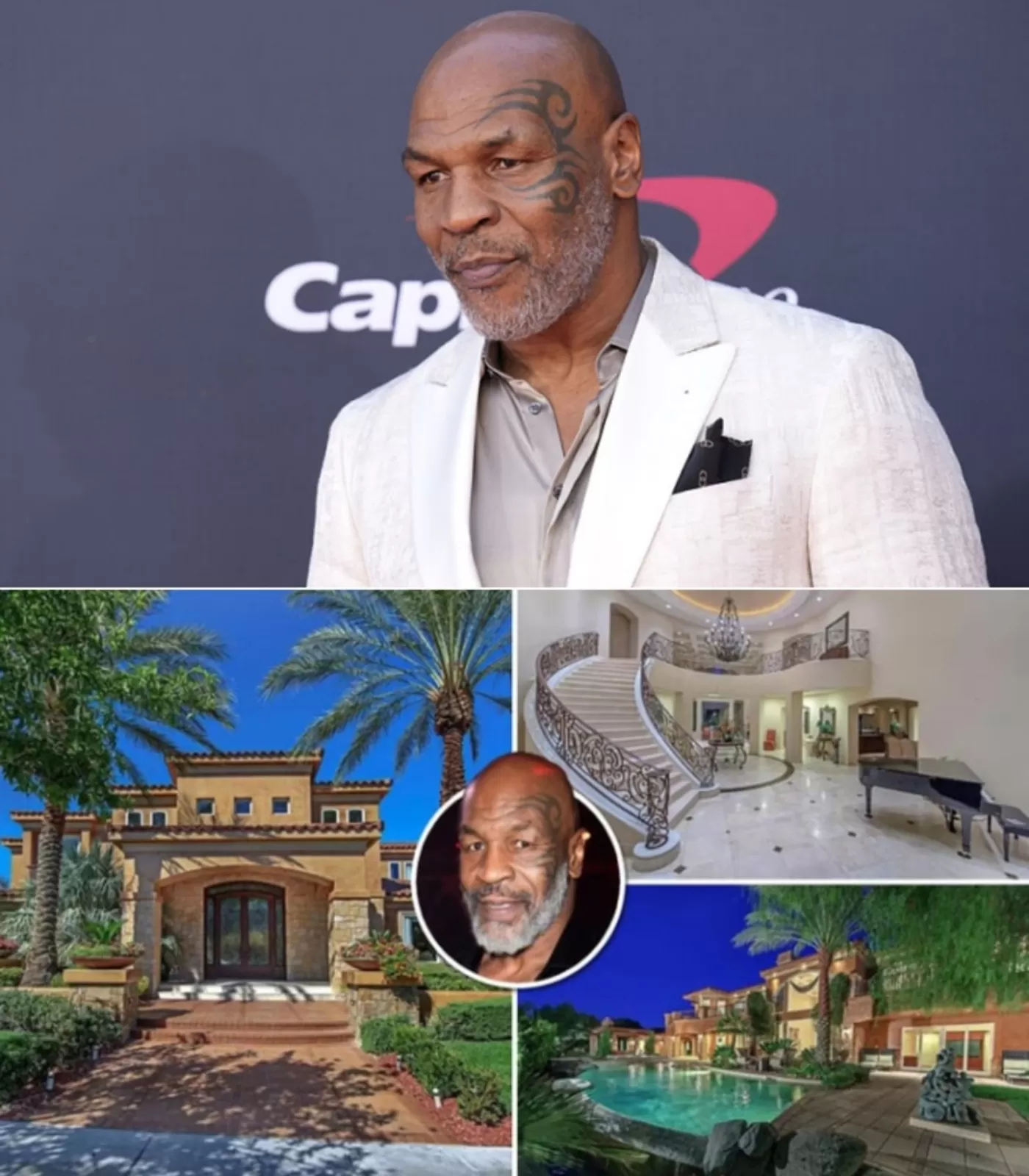

Mike Tyson, one of the greatest boxers of all time, earned over $300 million during his illustrious career. Yet, in 2003, he declared bankruptcy with debts amounting to $23 million. His story is a powerful reminder that wealth alone doesn’t guarantee financial security. Tyson’s journey offers valuable lessons about managing money wisely and avoiding financial pitfalls.

Tyson’s downfall was largely due to reckless spending. He lived an extravagant lifestyle, purchasing multiple mansions, luxury cars, and even exotic animals. At one point, he famously spent $2 million on a gold bathtub. This unchecked spending demonstrates the importance of financial discipline. No matter how much you earn, living beyond your means can lead to ruin. A budget and mindful spending are essential to maintaining financial stability.

Another contributing factor was poor financial management. Tyson trusted advisors who made questionable decisions and didn’t prioritize his long-term financial health. This mismanagement left him with mounting debts and unpaid taxes. The lesson here is clear: even with financial advisors, it’s crucial to stay informed about your own finances. Blind trust can be costly.

Tyson’s story also highlights the dangers of neglecting obligations like taxes and debts. Ignoring these responsibilities led to severe financial consequences, forcing him to liquidate assets to settle his dues. Prioritizing debt repayment and understanding tax obligations are non-negotiable aspects of responsible money management.

Despite his setbacks, Tyson’s recovery is a testament to resilience and adaptability. After losing everything, he diversified his income through acting, his podcast, and the cannabis industry. These ventures have helped him rebuild his wealth. His ability to reinvent himself shows the importance of creating multiple income streams to safeguard against financial uncertainty.

The key takeaway from Mike Tyson’s journey is that financial success isn’t just about how much you earn—it’s about how well you manage it. Practicing discipline, seeking trustworthy advice, and staying vigilant about obligations are critical to maintaining and growing wealth. Mistakes may happen, but Tyson’s comeback proves that recovery is possible with determination and smarter choices.

In the end, Tyson’s story serves as both a cautionary tale and an inspiration. By learning from his experiences, we can better prepare ourselves to achieve financial stability and resilience in our own lives.