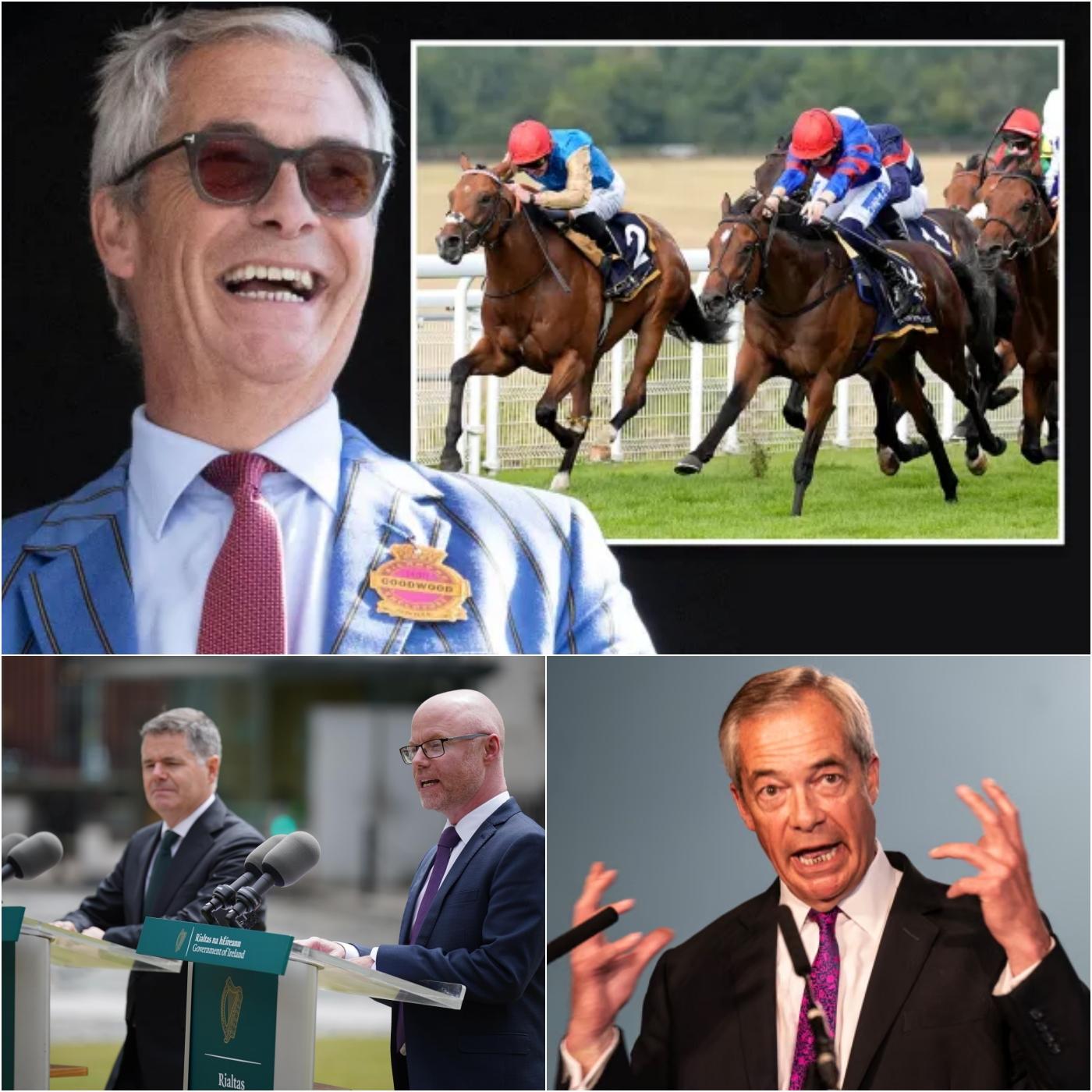

The British horse racing industry, a cornerstone of the nation’s cultural and economic fabric, faces a looming threat from proposed tax increases on gambling, prompting a fierce response from Reform UK leader Nigel Farage. The UK government’s plan to align betting taxes on horse racing with those of online slots and casinos has sparked widespread concern, with industry leaders warning of devastating consequences. Farage, a vocal advocate for preserving British traditions, has stepped into the fray, condemning the proposal as a misstep that could cripple an industry already under strain. His opposition, coupled with the British Horseracing Authority’s (BHA) campaign to “Axe the Racing Tax,” has ignited a debate that resonates far beyond the racetrack, touching on issues of economic policy, cultural heritage, and the balance between regulation and industry survival.

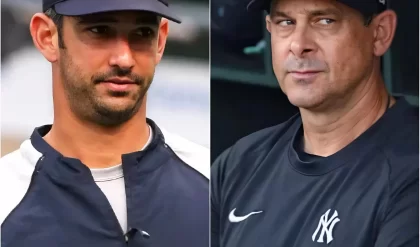

The proposed tax hike would raise the duty on horse racing bets from 15% to match the 21% levied on online slots and casinos, a move that independent economic modeling suggests could cost British racing £330 million within five years. More alarmingly, it could jeopardize over 2,750 jobs in the first year alone. Farage, speaking at Goodwood, didn’t mince words: “I think there’s also an ignorance here, there is an assumption from members of parliament that all gambling is bad, that all gambling leads to ruin. Some of those machines are pretty addictive. I think that horseracing is different.” His stance frames horse racing not as a vice but as a unique cultural institution, one that deserves protection rather than punitive taxation.

The BHA has rallied behind this sentiment, launching a public petition to demonstrate widespread opposition to the Treasury’s plans. Their “Axe the Racing Tax” campaign underscores the industry’s economic contributions, from supporting rural economies to generating millions in revenue through tourism and betting. The campaign paints a stark picture: a tax increase could trigger a domino effect, reducing prize money, deterring investment, and ultimately shrinking the sport’s footprint. Julie Harrington, BHA’s chief executive, emphasized the stakes: “This tax proposal risks undermining a sport that supports thousands of jobs and communities. It’s not just about racing; it’s about the livelihoods tied to it.”

Farage’s involvement adds a layer of political intrigue to the debate. As the leader of Reform UK, he has positioned himself as a defender of British interests, often challenging what he sees as misguided government policies. His presence at Goodwood, where he voiced his opposition, was no coincidence—some speculate it was a calculated move to align himself with an issue that resonates with his base. Posts on X have even suggested that his appearance, with tickets reportedly gifted by Goodwood Racecourse owners, was a strategic play to amplify his campaign. Yet, Farage’s commitment appears genuine, rooted in his broader critique of policies that he believes drive wealth and opportunity away from the UK. “Raising the duty would cause enormous damage to a really important part of what we do as a country,” he stated, signaling his intent to fight the proposal.

The government, led by Chancellor Rachel Reeves, defends the tax alignment as a way to streamline bureaucracy and ensure fairness across gambling sectors. A Treasury spokesperson clarified: “We are consulting on bringing the treatment of online betting in line with other forms of online gambling to cut down bureaucracy—it is not about increasing or decreasing rates, and we welcome views from all stakeholders.” This rationale, however, has met skepticism from industry leaders who argue that horse racing is fundamentally different from other forms of gambling. Unlike online slots, which rely on algorithms and instant gratification, horse racing is a sport steeped in tradition, requiring skill, knowledge, and community engagement. Grainne Hurst, CEO of the Betting and Gaming Council, warned: “Increasing taxes on regulated operators will not deliver higher revenues—it will simply push customers towards the growing, unsafe, illegal online gambling black market, where there are no protections, no safeguards, and no support for sport.”

The economic implications are staggering. British racing supports over 85,000 jobs and contributes £4.1 billion annually to the economy, according to BHA figures. A tax hike could erode these benefits, particularly in rural areas where racecourses are major employers. The National Trainers’ Federation has thrown its weight behind alternative proposals, such as increasing taxes on online casino games while sparing sports betting. This approach, they argue, would protect racing’s ecosystem while addressing concerns about problem gambling. A BGC spokesperson noted: “Any tax rise, whether on betting or gaming, affects the whole operation. That means less money available for sponsorship, media rights, and support for sports like racing, which is especially vulnerable.”

Farage’s critique taps into a broader narrative of government overreach and misunderstanding of cultural institutions. His history of challenging the establishment—whether on Brexit or tax policy—lends weight to his argument that the government fails to grasp the nuances of industries like horse racing. In a recent speech, he lambasted policies that drive wealth creators away, citing an “exodus of high taxpayers” as evidence of Britain’s declining attractiveness. This rhetoric aligns with his push for policies like the Britannia Card, a controversial proposal to lure wealthy non-doms back to the UK with tax breaks. While critics, including tax expert Dan Neidle, warn that such schemes could cost the economy billions, Farage insists they would boost investment and job creation—arguments he now extends to defending horse racing’s economic role.

The debate also raises questions about public perception of gambling. Farage’s assertion that horse racing is “different” resonates with those who see it as a sport rather than a mere betting vehicle. Unlike online casinos, racing involves a tangible connection to animals, trainers, and jockeys, fostering a sense of community and tradition. Yet, the government’s push to equate all gambling forms risks alienating this distinction. Posts on X reflect this tension, with some users praising Farage’s defense of racing as a cultural touchstone, while others question whether his involvement is more about political posturing than genuine concern.

As the consultation period continues, the racing industry and its supporters are mobilizing. The BHA’s petition has garnered thousands of signatures, signaling robust public backing. Industry leaders are urging fans to join the fight, warning that the tax could lead to a “vicious cycle of decline.” Farage, ever the populist, has seized the moment to position himself as a champion of the underdog—whether it’s the rural worker, the racecourse employee, or the punter who sees racing as more than a gamble. His words at Goodwood linger: “I will certainly be fighting it.” For an industry staring down an existential threat, that fight could determine its survival.

The stakes couldn’t be higher. Will the government heed the warnings and preserve a sport that defines British heritage, or will the tax hike push racing into a precarious future? As Farage and the BHA rally their forces, the outcome remains uncertain, but one thing is clear: the battle for British horse racing is far from over.