Jimmie Johnson Exposes NASCAR’s Feud Over Money and Power: Is This the Reckoning the Sport Feared?

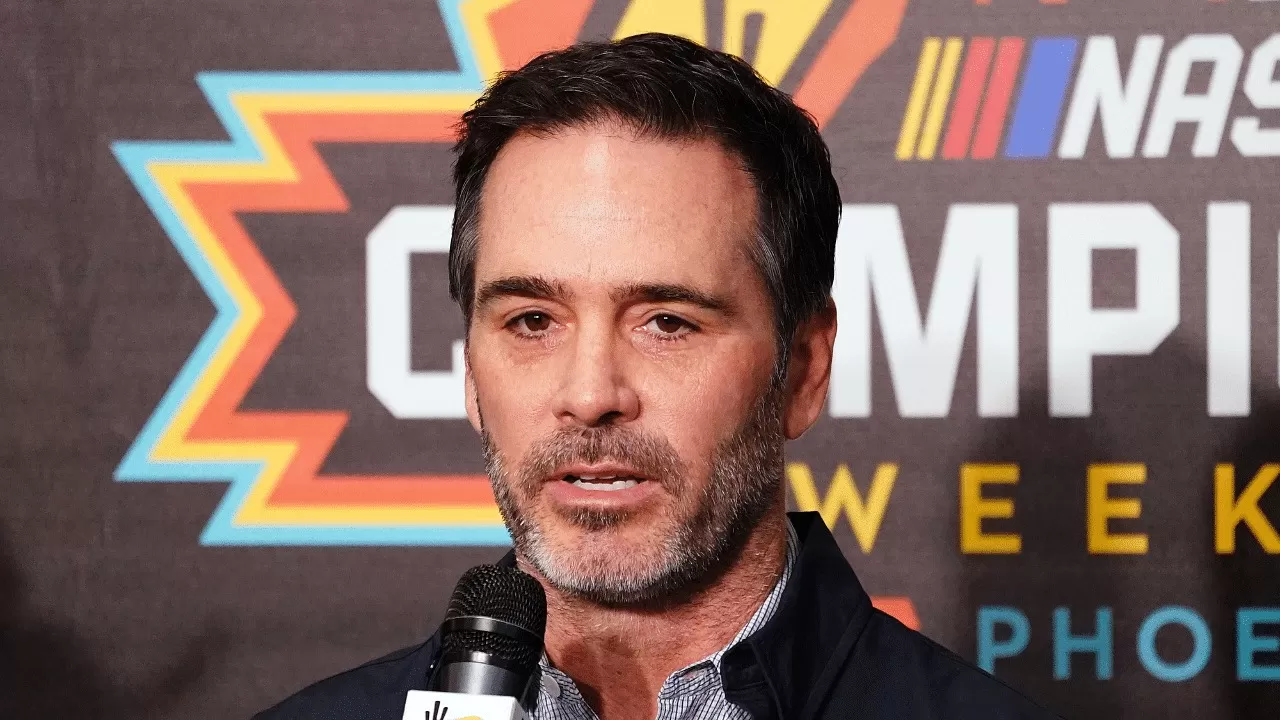

NASCAR, a titan in American motorsports with a fanbase that dwarfs Formula 1 in the U.S., is facing a storm that could reshape its future. In a raw and revealing interview on the *Business of Sport* podcast, NASCAR legend and team owner Jimmie Johnson pulled back the curtain on a bitter feud over money, power, and control. The seven-time Cup Series champion didn’t hold back, exposing how NASCAR’s tight grip on revenue has sparked an antitrust lawsuit from teams like Michael Jordan and Denny Hamlin’s 23/11 Racing and Front Row Motorsports. With the sport’s $7.7 billion media deal at the center of the conflict, Johnson’s comments have ignited a firestorm: is this the reckoning NASCAR has long feared?

Johnson, now a co-owner of Legacy Motor Club, offered a front-row seat to the growing rift between NASCAR and its teams. The core issue? A new charter agreement for the 2025 season that promised teams a bigger slice of media revenue but fell far short of expectations. Teams, hoping for a 50% share—similar to what leagues like the NBA offer—were stunned when negotiations with NASCAR dwindled their cut to just 29.5%. “We thought we’d get around 50% of media rights,” Johnson revealed. “But every time we negotiated, there was less on the table. It was a gut punch.” For teams banking on a fairer deal to ensure financial sustainability, this was a breaking point.

The frustration boiled over when NASCAR set a strict deadline for teams to sign the new charter agreement, leaving some feeling strong-armed into compliance. While most teams reluctantly agreed, 23/11 Racing and Front Row Motorsports refused, launching an antitrust lawsuit against NASCAR. The lawsuit accuses the sanctioning body of monopolistic practices, alleging that its family-run structure—controlled by the France family—unfairly hoards profits and restricts competition. Teams argue that NASCAR’s centralized control over tracks, charters, and revenue streams like gambling and international rights creates an uneven playing field, prioritizing the France family’s interests over the teams’ survival.

NASCAR isn’t structured like a traditional sports league such as the NFL. It’s a family business, with the France family owning the sport and half the tracks where races are held, while the Smith family’s Speedway Motorsports controls the other half. This setup allows NASCAR to rake in revenue from ticket sales, sponsorships, gambling, and global expansion—none of which teams currently share. Johnson highlighted the disparity: “Our revenue share only comes from U.S. media rights, not track sales, not NASCAR’s sponsorships, not new money from gambling or international growth.” With NASCAR’s popularity soaring—boasting record TV viewership second only to the NFL and expanding into markets like Mexico City—this exclusion stings even more.

The antitrust lawsuit, now dragging on for eight months, has become a battle for NASCAR’s soul. A U.S. District Court granted a preliminary injunction, allowing 23/11 Racing and Front Row Motorsports to buy charters from the shuttered Stewart-Haas Racing and compete in 2025 despite not signing the agreement. But the bigger fight looms. Johnson warned that the process is being deliberately delayed, with rulings swinging back and forth between NASCAR and the teams. “One ruling is in favor of the teams, the next one’s in favor of NASCAR,” he said. “They just keep delaying the process.”

What’s at stake? Transparency, fairness, and the future of the sport. Teams are tired of being treated as private contractors in a family empire—they want a real partnership. Charters, now valued at $40 million and projected to hit $60 million soon, are critical for securing a spot on the grid and attracting sponsors. But if NASCAR doesn’t share more of its revenue streams, more teams might follow 23/11 and Front Row’s lead, potentially sparking a full-blown revolt or even a rival series on non-NASCAR tracks. Johnson sees a path forward, noting that charter negotiations will reopen in seven years. “We’ve weathered an 11-year system, and it’s directionally going right,” he said. But will NASCAR evolve before tensions explode?

Ironically, NASCAR has never been more popular, with Netflix’s *NASCAR: Full Speed* boosting its global appeal and new fans flocking to races. Yet behind the scenes, the sport remains stuck in an antiquated structure. As private equity floods in—Johnson’s own Legacy Motor Club partnered with Nighthood Capital Management—the pressure to modernize is mounting. This lawsuit could force NASCAR to rethink its playbook, sharing more revenue to ensure a sustainable future for teams and fans alike. If it doesn’t, the sport risks losing the very teams that make it a powerhouse. The question remains: will NASCAR listen, or will this feud mark the beginning of a seismic shift in motorsports?