Elon Musk, the billionaire entrepreneur known for revolutionizing electric vehicles, space travel, and digital payments, is facing one of the most significant setbacks of his career. The social media platform X, formerly known as Twitter, which Musk acquired for a staggering $44 billion in 2022, has experienced a dramatic collapse in both value and influence, sparking concern among investors, users, and even Musk’s closest allies.

A Rapid Descent

Once hailed as a bold reinvention of public discourse, X is now mired in controversy, financial distress, and a mass user exodus. Internal sources confirmed that the platform’s valuation has plummeted below $8 billion—an 80% drop since Musk’s acquisition. The platform, which Musk promised to turn into a “digital town square” and an “everything app,” is now being described by analysts as “a cautionary tale of overreach.”

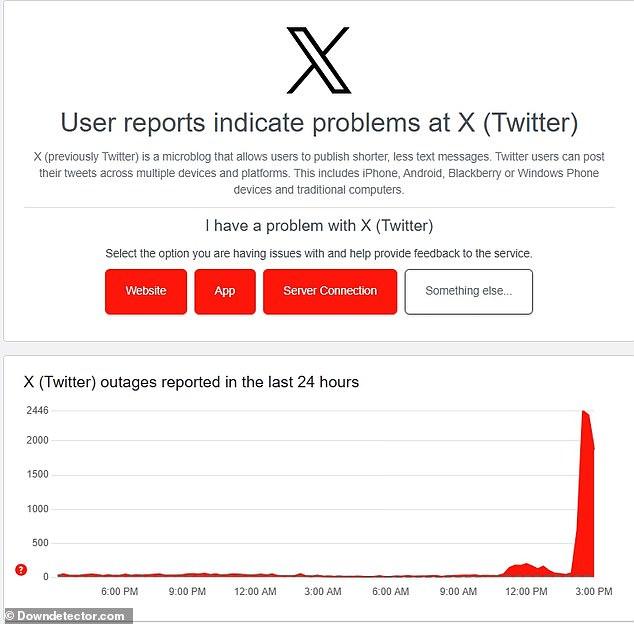

The situation came to a head this week when X suffered a major technical outage, knocking the platform offline for over 12 hours. For a company centered on real-time communication and immediacy, the failure proved catastrophic—not only in terms of user trust, but also in its stock value. Although X is privately held, the impact was reflected in Tesla and SpaceX shares, which both dipped following the news, illustrating the growing concern over Musk’s split attention and high-risk management style.

Layoffs, Lawsuits, and Losses

Since taking over the company, Musk’s aggressive changes have included mass layoffs—reducing staff from 7,500 to fewer than 1,000—along with the removal of content moderation systems and verification policies. These decisions have led to widespread criticism, an uptick in hate speech, misinformation, and a mass exit of major advertisers, including Apple, Disney, and Coca-Cola.

According to an internal financial report leaked last week, ad revenue has dropped nearly 60% year-over-year, while subscription-based revenue from X Premium has failed to fill the gap. Despite Musk’s efforts to push users toward paid features, adoption has remained low, with only 2% of the platform’s user base opting in.

Furthermore, X is currently facing multiple lawsuits—from former employees alleging wrongful termination to watchdog organizations accusing the platform of enabling harassment and disinformation. The U.S. Federal Trade Commission (FTC) has reportedly reopened investigations into X’s data privacy practices and user protections.

Musk Remains Defiant

In typical Musk fashion, the tech mogul remains publicly unfazed. On Thursday, he posted on X:

“Adversity is just another name for opportunity. X will rise again. We are innovating faster than any platform on the planet.”

While some loyal fans praised his optimism, industry analysts and insiders are growing increasingly skeptical. “Elon Musk’s visionary mindset doesn’t always translate into effective leadership,” says Sarah Klein, a tech industry analyst at Forecaster Group. “He disrupted car manufacturing and space exploration—but running a social media company is an entirely different beast.”

Klein added that Musk’s insistence on micromanagement and his erratic decisions—such as unbanning controversial figures and engaging in public feuds with journalists—have created a volatile environment that deters both users and investors.

Impact on Musk’s Empire

The crash of X comes at a critical moment for Musk. Tesla is facing increasing competition from Chinese EV manufacturers, while SpaceX is under pressure to meet aggressive launch targets and regulatory expectations. Neuralink, his brain-chip company, recently faced a safety-related pause on human trials, and The Boring Company’s tunnel projects remain behind schedule.

Together, these setbacks are raising concerns about Musk’s ability to effectively juggle multiple high-stakes ventures. While his loyal fanbase still sees him as a genius innovator, institutional investors are beginning to question whether his attention is spread too thin.

A Future in Question

With user numbers declining, ad revenue drying up, and regulators circling, the future of X hangs in the balance. Some speculate Musk may seek to offload the platform—possibly at a fraction of its purchase price—while others believe he will double down, pouring more of his personal fortune into its resurrection.

“Twitter was never a simple business to begin with,” says Joanna Peters, former head of digital operations at Meta. “Turning it into X—a platform that tries to be everything at once—only made the fall steeper.”

As the world watches one of the richest men grapple with one of his most visible failures, one thing is clear: Elon Musk’s $44 billion gamble on X has turned into a cautionary tale for tech titans and dreamers alike.