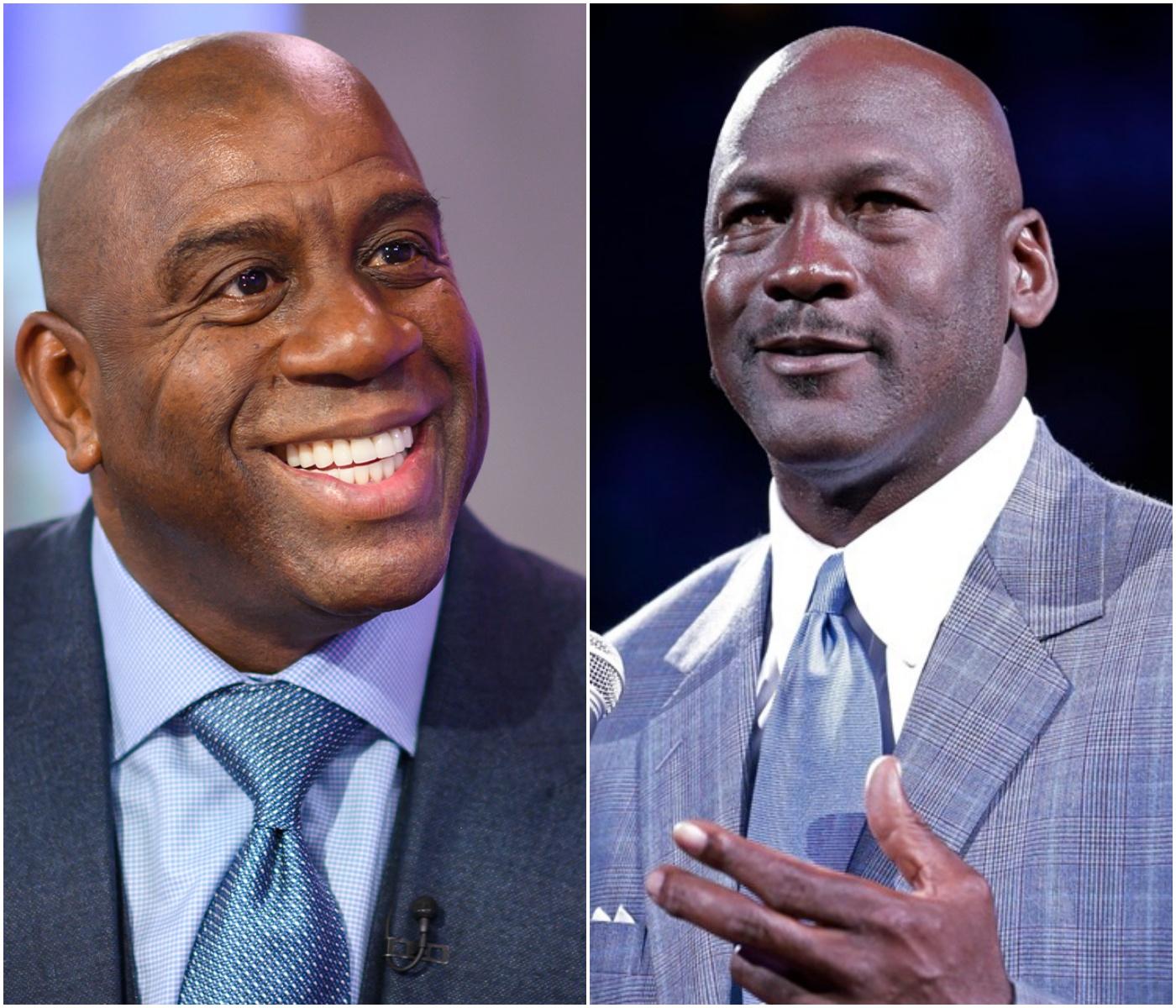

Earvin “Magic” Johnson, one of the most iconic figures in NBA history, is celebrated not only for his basketball prowess but also for his remarkable business acumen. With a net worth estimated at $1.2 billion by Forbes in 2023, Johnson has solidified his place among the world’s elite athlete billionaires, joining Michael Jordan, LeBron James, and Tiger Woods. Yet, a pivotal decision early in his career, influenced by a close friend, may have cost him the chance to become the world’s first trillionaire, a title that remains out of reach for even the wealthiest individuals today. Meanwhile, his longtime friend and rival, Michael Jordan, has surged ahead with a net worth of approximately $3.2 billion, cementing his status as the richest athlete in history.

The story begins in 1979, when a young Magic Johnson, fresh off leading Michigan State to an NCAA championship, was entering the NBA as the first overall draft pick by the Los Angeles Lakers. At the time, Nike, a fledgling sportswear company, approached Johnson with an innovative offer: a deal that included $1 for every pair of sneakers sold and 100,000 shares of company stock. Unfamiliar with the concept of stock ownership and coming from a family without significant financial wealth, Johnson sought advice from those around him, including a close friend who steered him toward a more immediate payoff. Following this counsel, Johnson declined Nike’s offer and instead signed with Converse, which provided a guaranteed $100,000 per year in cash. Reflecting on this decision years later on the All The Smoke podcast, Johnson lamented, “My family didn’t come from money… I didn’t even know what stocks were at that time.”

The consequences of that choice were monumental. Nike’s stock skyrocketed over the decades, and by 2023, those 100,000 shares would have been worth approximately $5.2 billion, a figure that could have positioned Johnson as one of the wealthiest individuals alive. Had he held onto the stock and reinvested dividends, some speculate his wealth could have approached trillionaire status by now, especially with strategic investments in other burgeoning industries. Instead, Johnson’s decision to opt for short-term security over long-term potential altered his financial trajectory.

In contrast, Michael Jordan, who entered the NBA in 1984, seized a similar opportunity with Nike. His partnership with the company birthed the Air Jordan brand, a cultural and commercial juggernaut that continues to generate billions in revenue. Jordan’s deal included royalties and equity, which, combined with his business ventures, such as his majority ownership of the Charlotte Hornets (sold in 2023 for a massive profit), propelled his net worth to $3.2 billion. Jordan’s foresight and willingness to embrace risk set him apart, allowing him to outpace Johnson and other peers in wealth accumulation.

Despite this missed opportunity, Johnson’s business career is nothing short of extraordinary. After retiring from the NBA in 1996, he built Magic Johnson Enterprises into a powerhouse, focusing on underserved urban communities. His 60% stake in EquiTrust Life Insurance, acquired in 2015, has been a cornerstone of his wealth, growing the company’s assets from $16 billion to $26 billion, with annual revenues of $2.6 billion. Johnson also holds minority stakes in the Los Angeles Dodgers, Washington Commanders, Los Angeles Sparks, and LAFC, showcasing his knack for diverse investments. His partnerships with Starbucks and movie theater chains in minority neighborhoods further highlight his commitment to social impact alongside profit.

The irony is that Johnson and Jordan, once fierce rivals on the court, remain close friends off it. In a 2025 appearance on Jimmy Kimmel Live!, Johnson shared how they vacation together in Europe, flipping a coin to decide who pays for dinner. Yet, their financial paths underscore different approaches to risk and opportunity. Johnson’s story is a cautionary tale about the importance of financial literacy and long-term thinking, particularly for young athletes from modest backgrounds. While he missed the Nike windfall, his resilience and strategic investments have still made him a billionaire.

Jordan, however, embodies the pinnacle of capitalizing on one’s brand and market potential. His dominance in both sports and business has left him unmatched among athletes in wealth. As Johnson himself acknowledged, “Man, Michael Jordan would have been making me so much money.” While the trillionaire milestone remains elusive, the tale of these two legends serves as a powerful lesson in the choices that shape financial destinies.