The question of whether retirees should be totally tax exempt has raised a considerable debate in recent years. Many argue that retirees have already contributed their fair part to society through decades of hard work and tax payment, and therefore, they should be exempt from greater financial charges. On the other hand, some believe that tax obligations should be applied to all citizens to guarantee a fair and sustainable economy. Let’s explore the key arguments of both sides of this discussion.

The case of fiscal exemption for retirees

- They have already paid their quotasRetirees have spent decades working, earning income and paying taxes at different levels: federal, state and local. Throughout their careers, they have contributed to programs such as Social Security, Medicare and Public Infrastructure. Since these systems have supported financially for years, many argue that it is fair to grant them a fiscal relief during retirement.

- Fixed income makes taxes a burdenMost retirees depend on fixed income, mainly pension, social security benefits and retirement savings. Unlike people who work, they do not have the flexibility of earning more income to compensate for tax payments. Paying taxes on your limited resources could generate financial difficulties, which would make it difficult to pay essential needs such as medical care, housing and daily expenses.

- Promote saving and economic participationIf retirees were exempt from taxes, they would have more income available to spend on assets, services and leisure activities. This increase in spending could help stimulate local economies and support companies. In addition, offering tax incentives to retirees could encourage younger generations to save more for their own retirement.

- Moral and ethical considerationsMany believe that taxing retirees is unfair, since they have contributed to society for decades. Retirement should be a moment of financial security and relaxation, not an additional period of stress caused by continuous tax obligations. Granting tax exemptions would be a way of showing thanks for their life efforts.

The case against tax exemption for retirees

- Sustainability of public servicesFiscal income finances essential services, such as health care, infrastructure and public safety. If retirees were completely exempt, governments could have difficulty generating enough income to maintain these services. This could be a heavier load for younger and workers taxpayers, which could lead to higher tax rates for them.

- Not all retirees have economic problemsWhile some retirees live with limited revenues, others enjoy significant wealth coming from large investments, properties and pensions. A general tax exemption would benefit the rich as much as it would help those in need, which could lead to an imbalance in economic equity.

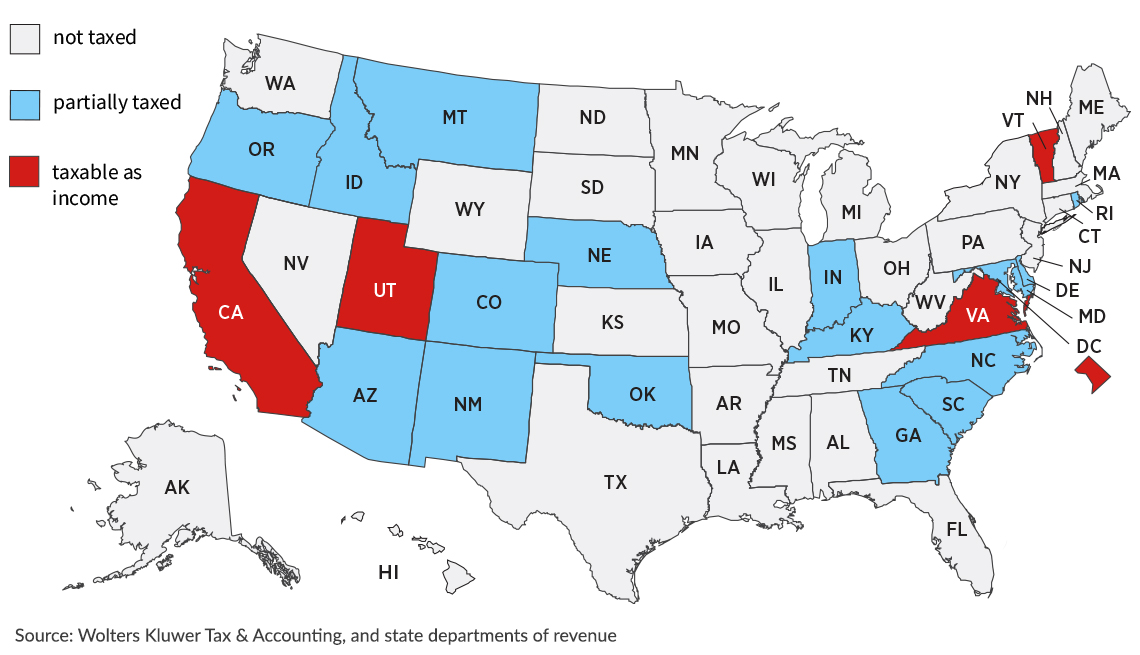

- Alternative fiscal relief optionsInstead of a total tax exemption, governments could offer specific fiscal relief measures, such as reduced tax rates on retirement income, higher standard deductions or exemptions on social security benefits. These measures would help retirees without completely eliminating their tax contributions.

- Maintain intergenerational equityIf retirees were totally tax exempt, financial responsibility to finance public services would fall to a greater extent on younger generations. This could create resentment among workers who would have to compensate for the loss of income, which could tighten intergenerational relationships.

Middle point

While the idea of a total tax exemption for retirees is attractive, it may not be the most practical or sustainable solution. A balanced approach would imply providing fiscal relief to those who need it most and, at the same time, ensure that retirees with important financial resources continue to contribute. Governments could explore progressive fiscal policies that exempt low -income retirees and, at the same time, maintain fair taxation for richer people.

In short, the debate revolves around equity, sustainability and the role of taxes in society. While retirees deserve financial security and recognition for their contributions, any policy change must carefully consider economic viability and intergenerational equity. A well structured tax system should aim to provide relief without compromising the stability of public services and economy in general.