Formula 1 CEO Stefano Domenicali has sparked concerns among fans with recent hints about rotating European Grand Prix races, driven by the surging interest in street circuits worldwide and the growing influence of new markets, particularly the United States. The core issue lies in Formula 1’s ongoing balancing act between preserving iconic tracks and meeting the expanding demands of commercial stakeholders who see opportunities in hosting races in diverse, often unconventional, global locations.

The drive to expand F1’s reach, particularly into the U.S., has undoubtedly elevated the sport’s profile, ushering in record viewership numbers and new business partnerships since Liberty Media’s acquisition in 2017. However, the expansion has come with growing pains, as the calendar now includes 24 races, pushing the limits of both teams and drivers. Though FIA President Mohammed Ben Sulayem and Domenicali have agreed to cap the current race count, there are still ongoing discussions about potential changes. The most contentious of these is a proposal to rotate some European circuits annually, targeting venues that have historically been F1 staples, like Spa, Monza, and potentially even the legendary Monaco circuit.

The plan for biannual European races has not been universally embraced. Europe, long the heartland of Formula 1, has been home to some of the sport’s most dedicated fans and financially crucial venues. With an impressive ten races currently held across Europe (if Azerbaijan is included), this region has been crucial to F1’s heritage. Yet, certain venues are facing economic challenges to remain competitive, especially as newer, street circuit-friendly cities vie for race slots. Domenicali suggests that a rotational calendar could serve as a compromise, maintaining access to iconic European locations while freeing space for new entries.

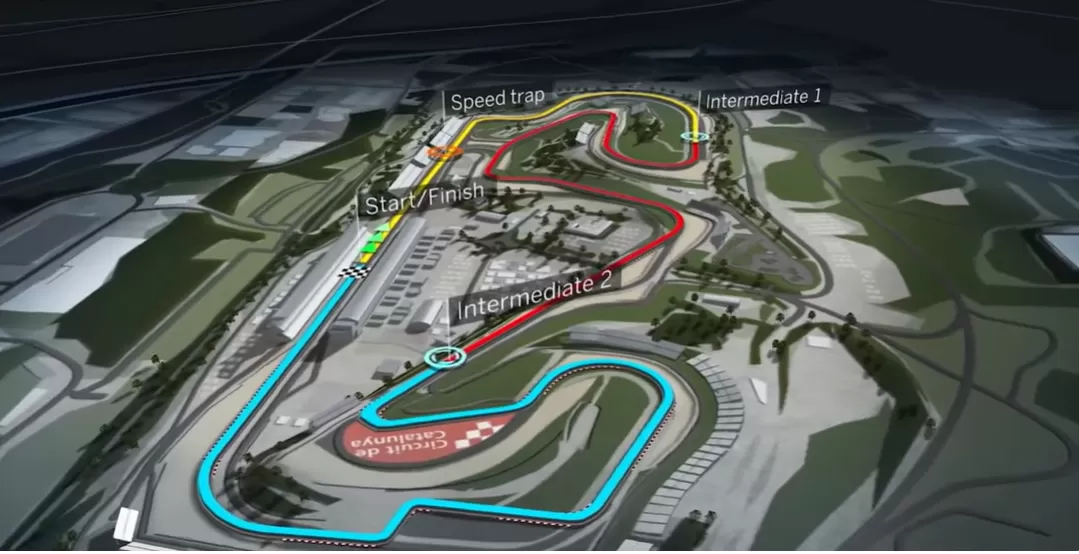

One particularly ambitious new race is set to debut in Madrid in 2026. The Spanish capital’s council has committed to building a semi-permanent circuit, optimistic about its potential revenue and cultural impact. However, officials have acknowledged the financial strain that adding this Grand Prix would impose on Spain’s budget, potentially putting Barcelona’s Grand Prix in jeopardy.

Domenicali’s European rotation proposal isn’t without precedent; previous F1 seasons have seen such considerations for circuits like Zandvoort, Monza, and Spa. Nonetheless, this rotation plan has raised questions about the overall impact on European fans. Losing permanent spots for beloved tracks, particularly Spa, could alienate the very fans who have supported F1 through its lows. The threat of losing Monaco, a circuit cherished for its challenging layout and glamour, underscores the tension between honoring tradition and meeting new market demands.

Meanwhile, F1’s Gulf region presence and its three U.S. races reflect the sport’s pivot toward areas with strong commercial backers. Yet, fans and drivers have voiced concerns over racing in areas with questionable human rights records and increasingly congested street circuits, which can detract from the purity of traditional racing.

In light of these shifts, Domenicali and the F1 management face a delicate balancing act. Prioritizing newer, profitable locations over legacy circuits risks diminishing Formula 1’s European roots. With contracts expiring for several historic circuits in 2025, the possibility of rotating venues may soon become a reality. The outcome of these decisions will undoubtedly shape the future of Formula 1, defining its relationship with both loyal fans and a rapidly evolving global audience.